Protecting America’s Seniors from Online Scams – 2025

Each year, tens of thousands of older Americans fall victim to online scams, losing billions of dollars in hard-earned savings and retirement funds. In 2024 alone, more than 147,000 seniors reported losing approximately $4.9 billion to cybercriminals, according to data from the FBI’s Internet Crime Complaint Center (IC3). That means, tragically, every four minutes, another older American’s financial security, dignity, and independence are severely compromised.

Online scammers deliberately target older adults, exploiting their trust, isolation, and sometimes limited experience with technology. The consequences extend far beyond financial losses, causing severe emotional distress, family turmoil, and lasting damage to health and independence. It is crucial, therefore, to understand the types of scams most commonly faced by American seniors and how best to prevent them.

Common Elder Scams in the United States

Among the various frauds that seniors face, certain types occur with troubling frequency. Investment scams are a leading threat, where criminals offer fake or misleading opportunities promising high returns with little or no risk. Often, these scams begin subtly on social media or dating platforms before escalating into cryptocurrency schemes or complex pyramid structures.

Tech support scams are another major threat. Criminals pose as representatives from trusted companies like Microsoft, Apple, or internet service providers, falsely claiming a senior’s computer or personal data is compromised. They pressure their victims to provide remote access to their devices, eventually stealing financial information or charging exorbitant fees for fake services.

Romance scams tragically exploit emotional vulnerability, loneliness, and isolation. Scammers establish seemingly genuine relationships online, quickly expressing strong feelings of love or friendship. Once trust is established, these scammers fabricate emergencies or urgent needs, convincing victims to send money, often repeatedly and in large amounts.

Government impersonation scams are particularly malicious, as fraudsters pretend to be officials from respected agencies like the IRS, Medicare, Social Security Administration, or even law enforcement. They threaten seniors with arrests, suspended benefits, or fines, creating panic and pressuring immediate payment through untraceable methods, such as wire transfers or gift cards.

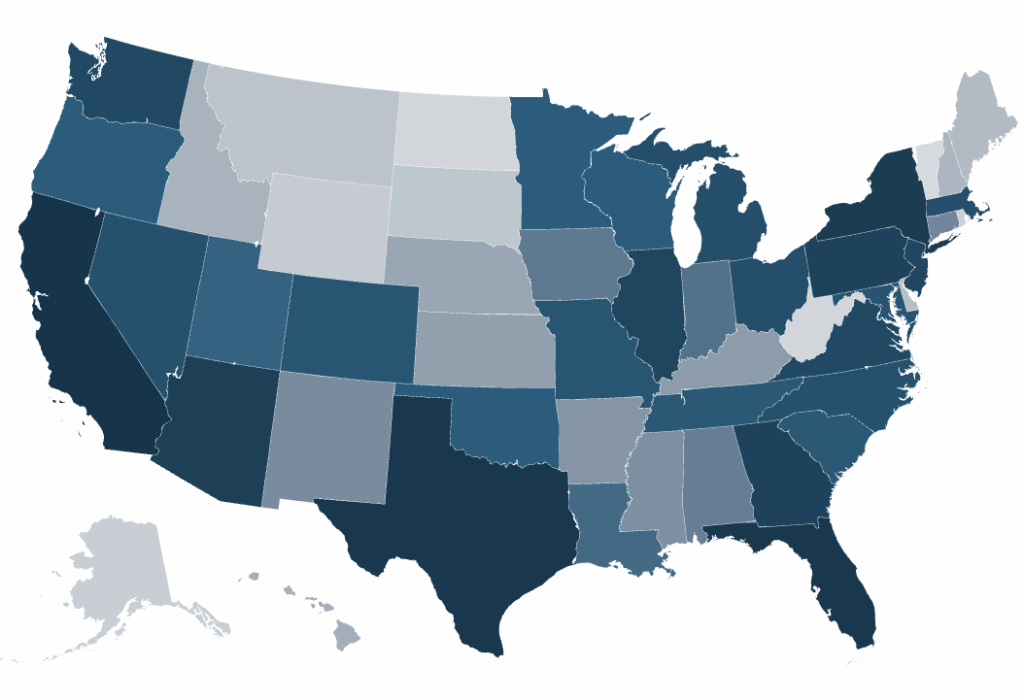

Heat Map – Elder Fraud Victims Per State

Elder Fraud Victims per State (2024)

| Rank | State / Territory | Total Loss |

| 1 | California | $832,710,048 |

| 2 | Texas | $489,790,386 |

| 3 | Florida | $388,436,198 |

| 4 | New York | $257,658,301 |

| 5 | District of Columbia | $251,454,544 |

| 6 | Arizona | $190,686,835 |

| 7 | Georgia | $174,744,201 |

| 8 | Pennsylvania | $151,096,514 |

| 9 | Illinois | $133,794,241 |

| 10 | New Jersey | $133,397,512 |

| 11 | Washington | $107,052,160 |

| 12 | Virginia | $106,575,141 |

| 13 | Massachusetts | $99,804,762 |

| 14 | Ohio | $95,441,773 |

| 15 | Michigan | $92,378,793 |

| 16 | North Carolina | $87,449,567 |

| 17 | Nevada | $81,400,930 |

| 18 | Maryland | $80,128,654 |

| 19 | Colorado | $74,760,501 |

| 20 | Missouri | $63,530,750 |

| 21 | Tennessee | $61,882,884 |

| 22 | South Carolina | $58,581,997 |

| 23 | Minnesota | $52,262,721 |

| 24 | Wisconsin | $50,525,457 |

| 25 | Oklahoma | $50,203,394 |

| 26 | Oregon | $48,116,839 |

| 27 | Utah | $44,155,961 |

| 28 | Louisiana | $37,512,993 |

| 29 | Indiana | $37,209,947 |

| 30 | Iowa | $34,991,114 |

| 31 | Alabama | $33,200,314 |

| 32 | Connecticut | $30,918,559 |

| 33 | New Mexico | $30,034,919 |

| 34 | Mississippi | $28,870,444 |

| 35 | Arkansas | $27,253,501 |

| 36 | Kentucky | $26,139,251 |

| 37 | Kansas | $23,511,153 |

| 38 | Nebraska | $21,414,248 |

| 39 | Puerto Rico | $20,183,422 |

| 40 | Hawaii | $18,851,052 |

| 41 | Idaho | $18,663,392 |

| 42 | New Hampshire | $15,840,854 |

| 43 | Maine | $12,980,616 |

| 44 | Delaware | $12,293,619 |

| 45 | Montana | $12,056,193 |

| 46 | South Dakota | $8,975,829 |

| 47 | Wyoming | $8,648,675 |

| 48 | Alaska | $8,173,395 |

| 49 | Rhode Island | $6,309,411 |

| 50 | West Virginia | $5,790,489 |

| 51 | North Dakota | $5,781,845 |

| 52 | Vermont | $4,177,269 |

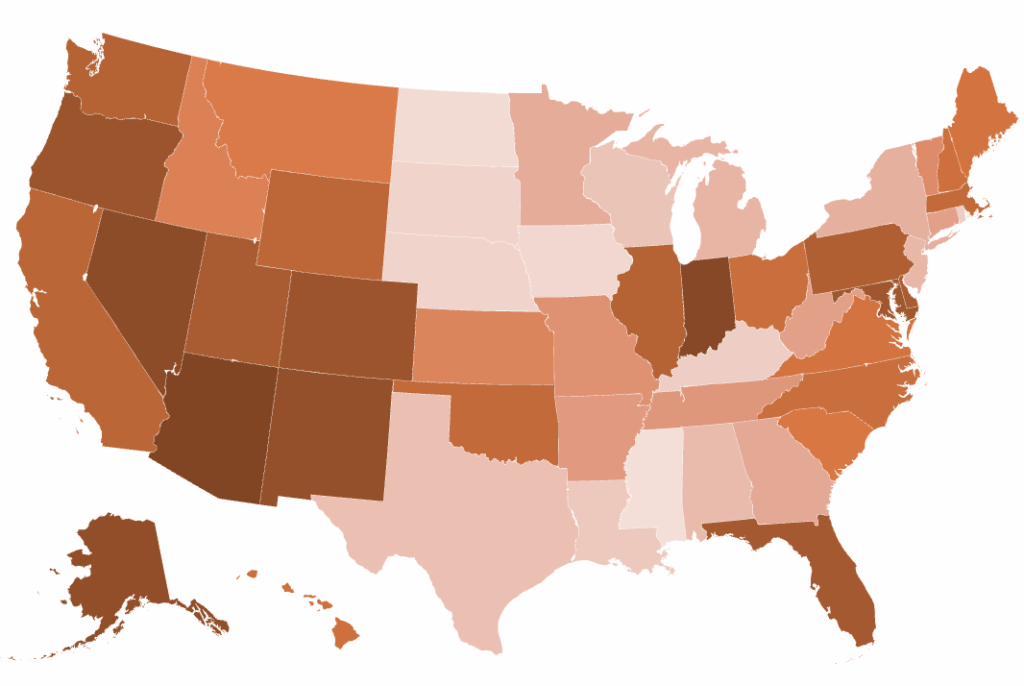

Heat Map – Elder Fraud Victims Rate Per State

Elder Fraud Victims Rate – Per 100,000 Population (2024)

Based on Official U.S. Census Bureau July 1, 2024 Population Estimates

| Rank | State | Victim Count | 2024 Population | Victims per 100k |

| 1 | Arizona | 6,683 | 7,582,384 | 88.14 |

| 2 | Indiana | 5,324 | 6,924,275 | 76.91 |

| 3 | Nevada | 2,299 | 3,267,467 | 70.36 |

| 4 | Alaska | 466 | 740,133 | 62.96 |

| 5 | New Mexico | 1,150 | 2,130,256 | 53.99 |

| 6 | Oregon | 2,288 | 4,272,371 | 53.53 |

| 7 | Colorado | 3,128 | 5,957,493 | 52.50 |

| 8 | Maryland | 3,231 | 6,263,220 | 51.59 |

| 9 | Florida | 11,902 | 23,372,215 | 50.93 |

| 10 | Utah | 1,762 | 3,503,613 | 50.26 |

| 11 | Delaware | 514 | 1,051,917 | 48.86 |

| 12 | Pennsylvania | 6,353 | 13,078,751 | 48.57 |

| 13 | Illinois | 6,064 | 12,710,158 | 47.71 |

| 14 | Washington | 3,692 | 7,958,180 | 46.40 |

| 15 | California | 18,091 | 39,431,263 | 45.87 |

| 16 | Wyoming | 267 | 587,618 | 45.44 |

| 17 | Oklahoma | 1,858 | 4,095,393 | 45.36 |

| 18 | Massachusetts | 3,224 | 7,136,171 | 45.17 |

| 19 | North Carolina | 5,031 | 11,046,024 | 45.54 |

| 20 | Ohio | 5,388 | 11,883,304 | 45.34 |

| 21 | New Hampshire | 633 | 1,409,032 | 44.92 |

| 22 | Hawaii | 647 | 1,446,146 | 44.74 |

| 23 | Virginia | 3,841 | 8,811,195 | 43.60 |

| 24 | Maine | 608 | 1,405,012 | 43.27 |

| 25 | South Carolina | 2,293 | 5,478,831 | 41.86 |

| 26 | Montana | 438 | 1,137,233 | 38.51 |

| 27 | Idaho | 775 | 2,001,619 | 38.72 |

| 28 | Kansas | 1,129 | 2,970,606 | 38.01 |

| 29 | District of Columbia | 267 | 702,250 | 38.01 |

| 30 | Vermont | 243 | 648,493 | 37.47 |

| 31 | Missouri | 2,199 | 6,245,466 | 35.20 |

| 32 | Tennessee | 2,543 | 7,227,750 | 35.18 |

| 33 | Arkansas | 1,063 | 3,088,354 | 34.42 |

| 34 | West Virginia | 594 | 1,769,979 | 33.56 |

| 35 | Connecticut | 1,209 | 3,675,069 | 32.90 |

| 36 | Georgia | 3,622 | 11,180,878 | 32.40 |

| 37 | Minnesota | 1,836 | 5,793,151 | 31.69 |

| 38 | New York | 6,225 | 19,867,248 | 31.33 |

| 39 | Michigan | 3,148 | 10,140,459 | 31.04 |

| 40 | New Jersey | 2,918 | 9,500,851 | 30.71 |

| 41 | Alabama | 1,567 | 5,157,699 | 30.38 |

| 42 | Texas | 9,473 | 31,290,831 | 30.28 |

| 43 | Wisconsin | 1,785 | 5,960,975 | 29.94 |

| 44 | Louisiana | 1,372 | 4,597,740 | 29.84 |

| 45 | Rhode Island | 324 | 1,112,308 | 29.13 |

| 46 | Kentucky | 1,336 | 4,588,372 | 29.11 |

| 47 | South Dakota | 259 | 924,669 | 28.01 |

| 48 | Nebraska | 551 | 2,005,465 | 27.48 |

| 49 | Iowa | 803 | 3,241,488 | 24.77 |

| 50 | North Dakota | 174 | 796,568 | 21.84 |

| 51 | Mississippi | 604 | 2,943,045 | 20.52 |

Recognizing the Warning Signs

Though scams vary widely, certain consistent warning signs can help seniors and their families identify potential threats. Offers or demands that seem unusually urgent, requests for secrecy, or promises of guaranteed returns are common indicators of fraud. Legitimate organizations will never insist on payments via gift cards, wire transfers, or cryptocurrencies. Likewise, official agencies will not threaten arrest or legal action over unsolicited phone calls, texts, or emails.

A sudden, unexpected outreach from anyone demanding personal information or payment should always be viewed with suspicion. Seniors should always take their time, consult a trusted family member or advisor, and independently verify the identity of the person or organization contacting them.

What to Do if Targeted by a Scam

If you or someone you care about suspects a scam, immediate steps are critical. First, pause and refrain from engaging further with the scammer—never provide financial details, send money, or allow remote computer access. Save any available evidence, such as emails, text messages, or voicemails, to aid authorities in investigating the scam.

It’s vital to inform someone you trust immediately. Speaking openly about the incident can not only help you avoid becoming a victim but can also help stop others from falling prey to similar schemes.

Reporting a Scam: Key Resources and Agencies

Reporting fraud promptly is essential in combating these crimes and preventing future victimization. To report online fraud or scams, you can contact the FBI’s Internet Crime Complaint Center (IC3) through their official website, ic3.gov. The Federal Trade Commission (FTC) also offers a straightforward reporting mechanism at ReportFraud.ftc.gov.

If a scam involves government impersonation, particularly related to Social Security, reports can be made directly to the Social Security Administration’s Office of Inspector General at oig.ssa.gov.

In cases involving financial loss, always notify your bank or financial institution immediately. They may be able to halt fraudulent transactions or help recover lost funds.

Empowering Families: The 15-Minute Conversation

Protecting seniors from scams is not only an individual responsibility but also a family and community effort. Families can greatly reduce risk by having open, compassionate conversations about online safety. Taking just 15 minutes during family gatherings or holidays to discuss a simple fraud prevention protocol can significantly increase resilience against these threats.

Consider establishing family rules: for example, agreeing on a secret family code word to verify identity in case of emergencies, promising to discuss unexpected financial requests with another family member, or committing to always independently verify unsolicited calls or messages before responding.

Staying Safe, Staying Informed

Education and awareness are your best defenses against scammers. Take advantage of free, reputable resources provided by organizations such as the FBI, FTC, and Consumer Financial Protection Bureau. These organizations offer detailed guides, instructional videos, printable checklists, and other tools specifically designed to help seniors and families remain informed, vigilant, and protected against fraud.

Scam patterns evolve constantly, making it essential to stay updated on emerging threats. Regularly checking trusted sources or subscribing to fraud alerts can make a significant difference in recognizing and preventing scams.

Together, through awareness, vigilance, and proactive communication, we can protect America’s seniors, ensuring that the dignity and financial security they’ve worked so hard to build remain safeguarded against criminals who seek to exploit them.

Get Help, Find Your State

This national resource provides critical guidance to protect American seniors, but help is also available closer to home. Each state has specific resources and contacts for local assistance. As you explore our site further, you’ll find dedicated pages for each state, containing local contact information, reporting procedures, and support networks designed specifically for residents in your area.

If you’ve been targeted by scammers, don’t hesitate to reach out, you’re not alone. Let’s build safer communities together, one family at a time.

Share Your Story

Have you or a loved one experienced a scam, or stopped one just in time? Your story could help protect someone else.

Share Your Story