Protecting Seniors From Investment Scams: How to Spot, Prevent, and Report Fraud

- What Is an Investment Scam Targeting Seniors?

- How Do Investment Scams Work?

- Common Types of Investment Scams Affecting Seniors

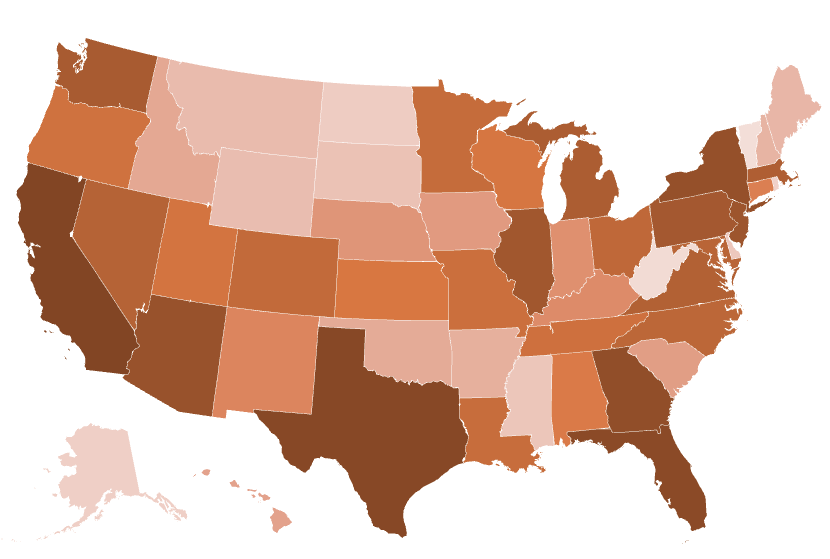

- US Heat Map – Investment Scams Targeting Seniors (2024)

- Seniors Affected by States

- Red Flags of an Investment Scam

- Why Are Seniors Targeted?

- How To Protect Yourself

- If You Suspect an Investment Scam

Already been scammed? Read our First 24 Hours Emergency Guide for critical steps to take immediately.

What Is an Investment Scam Targeting Seniors?

An investment scam targeting seniors is a fraudulent scheme in which criminals attempt to trick older adults into handing over money or personal information by promising high, low-risk, or guaranteed returns on a fake or misleading investment opportunity. These scams often use sophisticated tactics, sometimes exploiting trust, isolation, or lack of up-to-date financial knowledge, to convince seniors to invest in non-existent, worthless, or high-risk ventures.

How Do Investment Scams Work?

Investment scammers may contact seniors by phone, email, social media, mail, or even in person. They often pose as:

- Financial advisors, brokers, or government officials

- Representatives of legitimate-sounding companies or organizations

- New friends or romantic interests met online

Scammers typically use high-pressure tactics, such as:

- Promising unusually high or guaranteed returns with little or no risk

- Urging quick decisions to “lock in” the opportunity

- Using complex jargon or fake documents to appear credible

- Discouraging consultation with family or professional advisors

Common Types of Investment Scams Affecting Seniors:

- Ponzi or pyramid schemes (where returns to earlier investors are paid from new victims’ money)

- Fake stocks, bonds, or cryptocurrency investments

- Real estate or timeshare scams

- Precious metals, oil, or rare coin schemes

- “Senior-only” investment seminars or free lunch presentations

US Heat Map – Investment Scams Targeting Seniors (2024)

Seniors Affected by States

| Rank | State / Territory | Investment |

| 1 | California | $350,458,561 |

| 2 | Texas | $308,437,815 |

| 3 | Florida | $153,438,979 |

| 4 | Georgia | $82,957,738 |

| 5 | New York | $73,743,683 |

| 6 | Arizona | $68,021,190 |

| 7 | New Jersey | $65,981,098 |

| 8 | Illinois | $57,486,686 |

| 9 | Pennsylvania | $56,227,739 |

| 10 | Washington | $44,340,684 |

| 11 | Michigan | $42,618,288 |

| 12 | Massachusetts | $41,398,272 |

| 13 | Virginia | $41,242,306 |

| 14 | Nevada | $40,970,849 |

| 15 | Maryland | $37,370,364 |

| 16 | North Carolina | $33,012,508 |

| 17 | Ohio | $31,963,744 |

| 18 | Colorado | $26,479,901 |

| 19 | Minnesota | $21,997,390 |

| 20 | Louisiana | $20,842,485 |

| 21 | Missouri | $18,294,933 |

| 22 | Tennessee | $17,127,985 |

| 23 | Oregon | $16,817,393 |

| 24 | Utah | $16,504,979 |

| 25 | Wisconsin | $15,857,817 |

| 26 | Kansas | $14,837,122 |

| 27 | Alabama | $13,314,548 |

| 28 | Connecticut | $12,007,107 |

| 29 | New Mexico | $11,300,680 |

| 30 | Kentucky | $10,957,450 |

| 31 | Indiana | $10,565,371 |

| 32 | Nebraska | $10,451,810 |

| 33 | Iowa | $10,361,761 |

| 34 | South Carolina | $10,104,223 |

| 35 | Hawaii | $9,809,411 |

| 36 | Idaho | $8,504,289 |

| 37 | Oklahoma | $8,274,433 |

| 38 | Arkansas | $7,394,303 |

| 39 | New Hampshire | $5,893,104 |

| 40 | Maine | $5,450,171 |

| 41 | Montana | $5,352,023 |

| 42 | Wyoming | $4,609,991 |

| 43 | South Dakota | $4,594,352 |

| 44 | Mississippi | $4,295,035 |

| 45 | Delaware | $3,852,275 |

| 46 | North Dakota | $3,043,840 |

| 47 | Alaska | $1,702,443 |

| 48 | Rhode Island | $1,620,381 |

| 49 | Puerto Rico | $1,611,302 |

| 50 | District of Columbia | $776,156 |

| 51 | West Virginia | $683,320 |

| 52 | Vermont | $496,333 |

Red Flags of an Investment Scam:

- Promises of high, steady, or guaranteed returns with little risk

- Unregistered investments or sellers

- Requests for secrecy or urgency

- Unsolicited offers or pressure to invest quickly

- Difficulty withdrawing funds or getting clear answers

Why Are Seniors Targeted?

- Many seniors have retirement savings or home equity

- Scammers assume seniors are more trusting, less likely to report, or may be less familiar with new investment products (such as cryptocurrency)

How to Protect Yourself:

- Research any investment and check for registration with the U.S. Securities and Exchange Commission (SEC) or state securities regulators

- Be skeptical of unsolicited investment offers, especially those that promise quick or guaranteed profits

- Talk to trusted family members or a qualified financial advisor before making major financial decisions

- Never send money or provide personal information to someone you haven’t met in person or can’t verify

- You can follow our training to further enhance your knowledge and skills against invesment scam.

If You Suspect an Investment Scam:

- Report it to your local police, and FBI’s Internet Crime Complaint Center (ic3.gov)

- Notify your bank or financial institution immediately if money has been transferred

Remember: If it sounds too good to be true, it probably is. When in doubt, pause and get a second opinion.

State-Specific Investment Scam Resources

Find detailed investment scam prevention guides and local reporting contacts for your state:

- California Investment Scam Resources – $350M lost by CA seniors

- Texas Investment Scam Resources

- Florida Investment Scam Resources

- New York Investment Scam Resources

- Arizona Investment Scam Resources

- Pennsylvania Investment Scam Resources

- Vermont Investment Scam Resources

View national elder fraud statistics | Find your state Attorney General